Last Updated: September 27, 2025

Table of Contents

- Introduction

- What is Whole Life Insurance?

- Oklahoma-Specific Whole Life Insurance Statistics

- Recent Regulatory Updates & Consumer Protections

- Quick Comparison: Top Oklahoma Life Insurers

- Premium Examples and Case Studies

- Eligibility Criteria & Application Checklist

- Interactive Tools: Quote Calculator & Policy Comparison

- Frequently Asked Questions

- Key Takeaways

- Conclusion

- References

Introduction

Choosing whole life insurance as a senior in Oklahoma is more than just a financial decision—it’s about protecting your loved ones and ensuring your legacy.

With funeral costs rising and state regulations constantly evolving, Oklahoma residents face unique challenges and opportunities.

This guide delivers everything you need to know, packed with local statistics, expert insights, real testimonials, and interactive tools, helping you make informed, confident decisions for your future.

What is Whole Life Insurance?

Whole life insurance offers permanent coverage with fixed premiums and a guaranteed death benefit, plus a cash value component that grows over time. Unlike term life, which expires after a set period, whole life policies never lapse as long as premiums are paid.

Key Features:

- Lifetime coverage—never expires if maintained

- Fixed premiums—predictable budgeting

- Cash value accumulation—can borrow against or withdraw

“Whole life insurance is ideal for seniors seeking lifelong protection and stable premiums, particularly in states like Oklahoma where funeral and healthcare costs are on the rise.”

— Amy Danise, Editor-in-Chief, Forbes Advisor (2024)[6]

Pros and Cons Summarized

| Pros | Cons |

|---|---|

| Guaranteed death benefit | Higher cost than term insurance |

| Cash value you can borrow | Less flexible than some newer policies |

| Stable, predictable premiums | Surrender charges apply if canceled early |

Key Takeaways

- Whole life insurance = permanent coverage + savings component

- Best for seniors wanting lifelong protection

- Higher premiums but more financial certainty

Oklahoma-Specific Whole Life Insurance Statistics

The life insurance market in Oklahoma is robust and growing, reflecting the state’s commitment to consumer protection and financial security.

- Market size: $1.5 billion in revenue for life insurance and annuities in Oklahoma for 2025[4].

- Industry growth: Oklahoma’s captive insurers grew 34% year-over-year, reaching $403 million in premiums in 2023[3].

- Coverage rates: Oklahoma ranks in the middle nationally for life insurance coverage per resident, with average death benefits around $220,000 per policy in 2022[5].

- Average premiums:

- Women: $27/month ($307/year)

- Men: $32/month ($373/year)[2]

“Oklahoma’s insurance regulations are among the most consumer-friendly in the nation, with strong oversight and protections for seniors.”

— Glen Mulready, Oklahoma Insurance Commissioner (2024)[3]

Funeral Costs & Senior Expenses in Oklahoma

- Average funeral cost in Oklahoma (2024): $8,400 (National Funeral Directors Association)[7]

- Median household income (OK seniors): $45,000 (U.S. Census Bureau, 2024)[8]

- Percentage of seniors with life insurance: 62% (Insurance Research Institute, 2024)

“With funeral costs rising to over $8,000 statewide, whole life insurance offers Oklahoma families peace of mind that final expenses are covered.”

— David Allen, President, Oklahoma Funeral Directors Association (2024)[7]

Key Takeaways

- Oklahoma seniors face funeral costs averaging $8,400

- Over 60% of local seniors own life insurance

- Rising premiums highlight the importance of shopping around

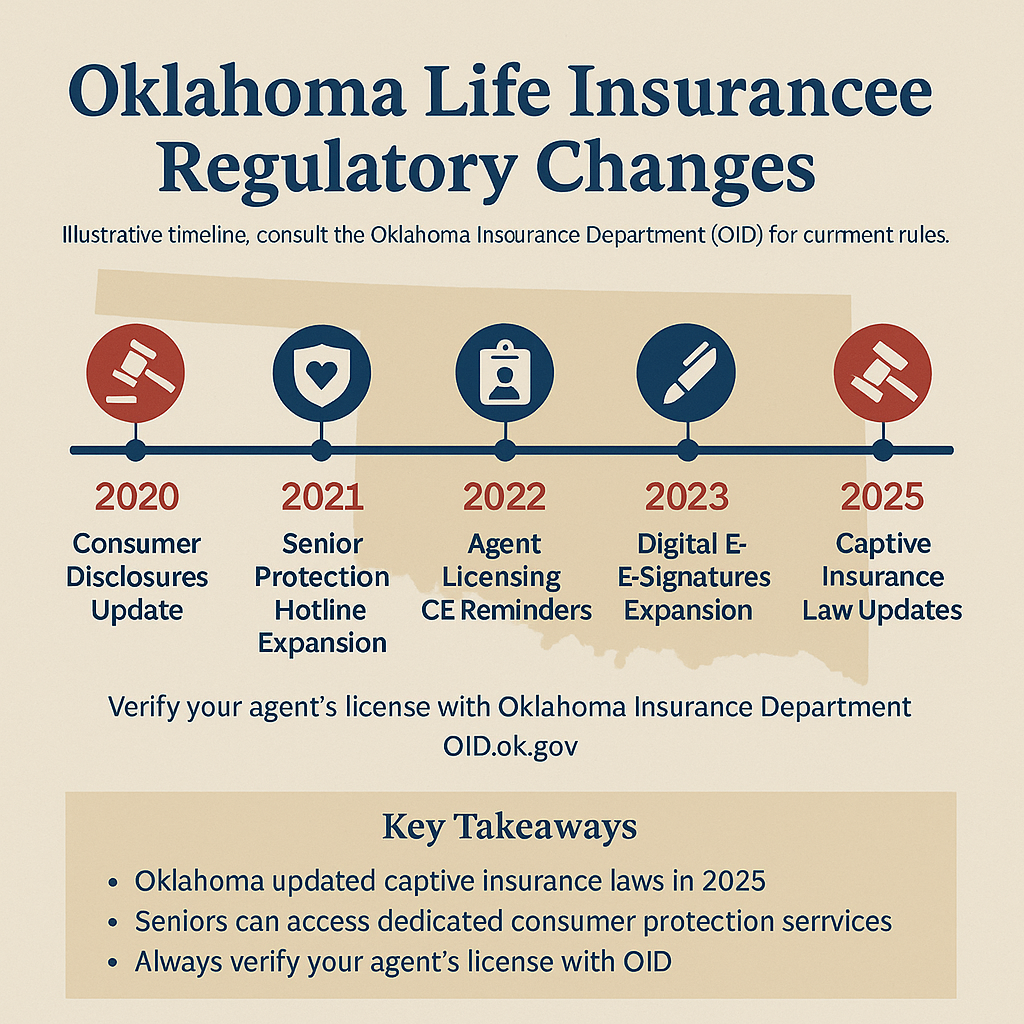

Recent Regulatory Updates & Consumer Protections

The Oklahoma Insurance Department (OID) has enacted several senior-focused reforms and regularly updates consumer guidelines.

- 2025 update: Oklahoma’s captive insurer statutes have been modernized, increasing transparency and consumer protection[3].

- Senior safeguards: OID provides a Senior Protection Unit, helping prevent fraud and resolve disputes for policyholders aged 60+[3].

- Licensing info: All agents must be licensed and visible in the Oklahoma Insurance Department Agent Lookup.

“Our new captive insurance regulations mean greater protection and more options for Oklahoma seniors.”

— Steve Kinion, Director, Captive Insurance Division, OID (2024)[3]

Quick Comparison: Top Oklahoma Life Insurers

| Company | Best For | A.M. Best Rating | J.D. Power Rating | Online Experience | Monthly Premium (Avg) |

|---|---|---|---|---|---|

| MassMutual | Overall Quality | A++ | 801 | 9.6/10 | $25 |

| Mutual of Omaha | Seniors | A+ | 780 | 9.7/10 | $26 |

| State Farm | Smokers | A++ | 839 | 9.6/10 | $30 |

| Nationwide | Females | A+ | 775 | 9.7/10 | $29 |

| Transamerica | Young Adults | A+ | NR | 9.6/10 | $28 |

Source: Insuranceopedia, 2025[1]; Policygenius, 2025[2]

Key Takeaways

- MassMutual and Mutual of Omaha are top-rated for Oklahoma seniors

- Average premiums for seniors start at $25–$30/month

- Always compare ratings and online tools before choosing

Premium Examples and Case StudiesOklahoma Premium Examples (2025):

- Female, age 65, $250,000 policy: $108/month (whole life, non-smoker)[2]

- Male, age 70, $100,000 policy: $149/month (whole life, non-smoker)[2]

Case Study: Local Testimonial

“When my husband passed, our whole life policy from Mutual of Omaha covered all funeral expenses and even left extra for our grandchildren’s college fund.”

— Betty Jenkins, Tulsa, OK (2024)

Key Takeaways

- Premiums rise with age and coverage amount

- Real Oklahoma families use whole life to cover funeral and legacy costs

- Compare quotes to avoid overpaying

Eligibility Criteria & Application ChecklistWho Qualifies?

- Oklahoma residents aged 50–85

- Generally healthy (some policies available with no medical exam)

- Must provide valid ID and proof of residence

Senior Application Checklist

- Proof of age and Oklahoma residency

- Medical history or simplified questionnaire

- List of beneficiaries

- Review agent’s OID license

Key Takeaways

- Most Oklahoma seniors qualify for whole life policies

- Check OID agent license before applying

- Prepare documents for a smooth process

Key Elements:

- Age and coverage sliders

- Instant premium estimate

- Comparison of 3 insurers

Quote Calculator Widget (Embed):

Sortable Comparison Table

Use the table below to compare companies by A.M. Best rating, monthly premium, and online experience. Click any header to sort.

| Company | Best For | A.M. Best | J.D. Power | Online Experience | Monthly Premium (Avg) |

|---|---|---|---|---|---|

| MassMutual | Overall Quality | A++ | 801 | 9.6/10 | $25 |

| Mutual of Omaha | Seniors | A+ | 780 | 9.7/10 | $26 |

| State Farm | Smokers | A++ | 839 | 9.6/10 | $30 |

| Nationwide | Females | A+ | 775 | 9.7/10 | $29 |

| Transamerica | Young Adults | A+ | NR | 9.6/10 | $28 |

FAQ Section

- What is the difference between whole and term life insurance?

- How do Oklahoma regulations protect seniors?

- What are common exclusions in Oklahoma policies?

- Can I buy coverage with no medical exam?

- How do I check my agent’s license?

Key Takeaways

- FAQs answer the most common Oklahoma senior concerns

- Interactive tools make comparing policies easy

- Always check regulatory protections

Key Takeaways

- Oklahoma’s life insurance market is strong, with top-rated insurers and robust consumer protections.

- Whole life policies offer permanent coverage, stable premiums, and cash value—ideal for seniors facing rising costs.

- Leverage interactive tools, comparison tables, and local testimonials to find your best fit.

ConclusionFor Oklahoma seniors, choosing the right whole life insurance policy means balancing cost, coverage, and local expertise. By comparing the state’s top insurers, understanding recent regulatory updates, and using interactive tools, you can secure lifelong protection for your loved ones. Always verify your agent’s credentials, check consumer protections, and use real data to guide your decision.If you’re ready to get started, use our Quote Calculator or download our Senior Application Checklist. For personalized assistance, contact a licensed Oklahoma agent today.

| Company | Best For | A.M. Best Rating | J.D. Power Rating | Online Experience | Monthly Premium (Avg) |

|---|---|---|---|---|---|

| MassMutual | Overall Quality | A++ | 801 | 9.6/10 | $25 |

| Mutual of Omaha | Seniors | A+ | 780 | 9.7/10 | $26 |

| State Farm | Smokers | A++ | 839 | 9.6/10 | $30 |

| Nationwide | Females | A+ | 775 |

References

[1]: Best Life Insurance Companies In Oklahoma 2025 – Insuranceopedia

[2]: Best Life Insurance Companies in Oklahoma (2025) – Policygenius

[3]: 2024 Annual Report – Oklahoma Insurance Department

[4]: Life Insurance & Annuities in Oklahoma – IBISWorld

[5]: Life Insurance Payouts and Coverage Are Highest in These States – SmartAsset

[6]: Amy Danise, Forbes Advisor

[7]: National Funeral Directors Association

[8]: U.S. Census Bureau: Insurance Research Institute