Introduction

Navigating life insurance can be complex, especially when choosing between whole life and term policies. In Oklahoma, families, farmers, and business owners face unique challenges and opportunities.

This comprehensive guide demystifies whole life insurance, compares it with term life, shares real Oklahoma stories, and equips you with interactive tools to make an informed decision.

Quick Summary

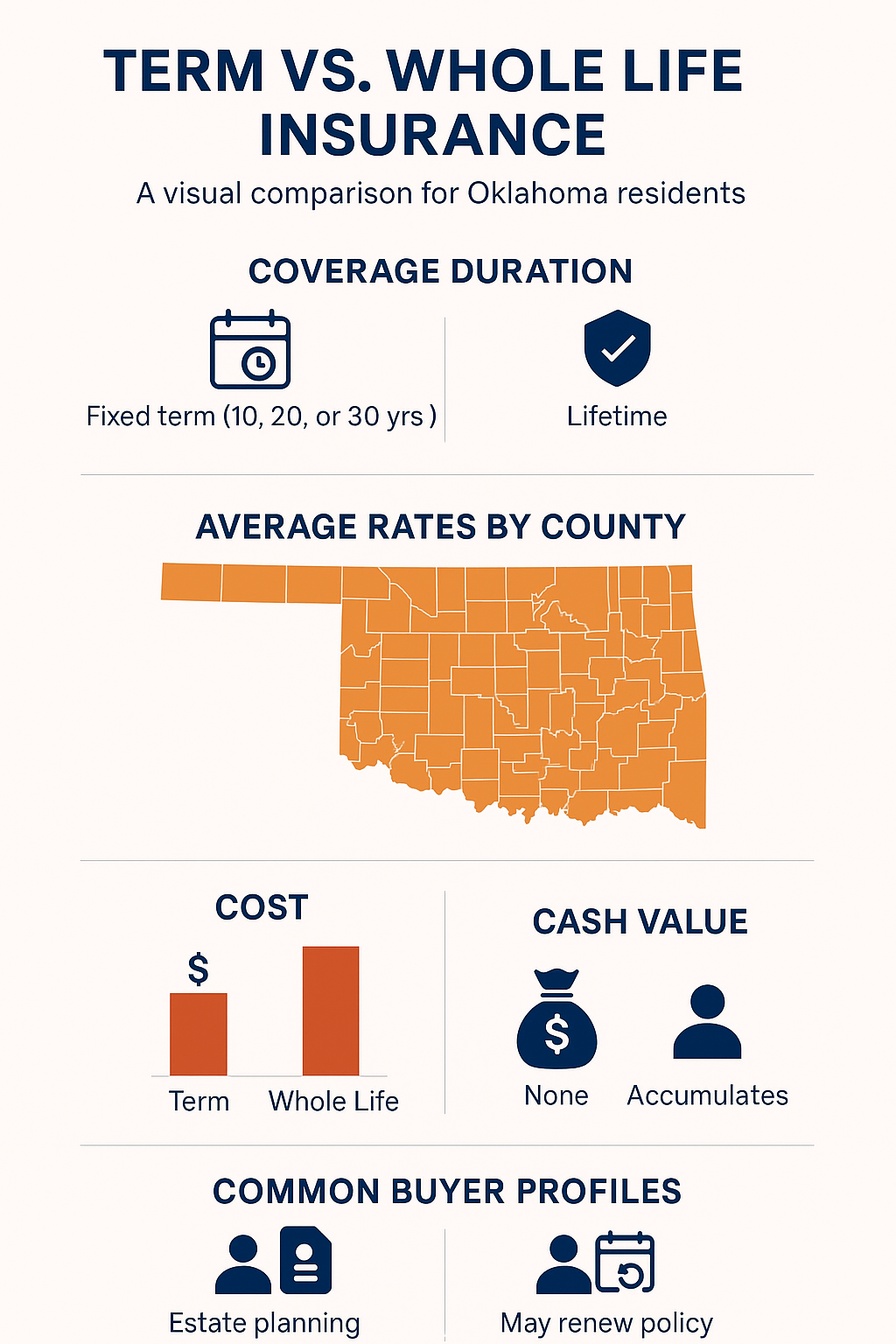

Whole life insurance offers permanent coverage with fixed premiums and a cash value component, while term life provides temporary, affordable protection.

Oklahoma rates vary, and choosing the right policy requires understanding your goals, budget, and local trends. Use our comparison table and calculator to model costs and outcomes.

- Introduction

- Quick Summary

- Whole Life Insurance: What Is It?

- Whole Life Insurance Pros and Cons

- Oklahoma Whole Life Insurance Rates and Trends

- Interactive Tools: Calculators & Widgets

- Buyer Personas: Who Chooses Whole Life in Oklahoma?

- Case Studies: Oklahoma Families, Farmers, and Small Businesses

- Expert Quotes & Industry Endorsements

- FAQ: Whole Life Insurance in Oklahoma

- Key Takeaways

- Conclusion

- References

- Editorial Policy and Author Credentials

- Update Log

Whole Life Insurance: What Is It?

Whole life insurance is a type of permanent life insurance designed to last your entire life, provided premiums are paid. Unlike term policies, it builds cash value, which grows on a tax-deferred basis and can be borrowed or withdrawn for emergencies[2].

How Does Whole Life Differ From Term Life?

| Feature | Whole Life Insurance | Term Life Insurance |

|---|---|---|

| Coverage Duration | Lifetime | Fixed term (10, 20, 30 yrs) |

| Premiums | Fixed, higher | Lower, may increase at renewal |

| Cash Value | Accumulates tax-deferred | None |

| Investment Component | Yes, with guaranteed growth | No |

| Flexibility | Less flexible | More flexible (select term) |

| Policy Modifications | Possible (death benefit, premiums) | Not modifiable |

| Estate Planning | Useful for inheritance, estate taxes | Limited utility |

“Term life is temporary, less expensive, and doesn’t build cash value. Whole life builds cash value, is more expensive, and provides lifelong coverage.” – Funeral Advantage (2023)[4]

Transition: Now that you know the basics, let’s dive deeper into the pros and cons.

Whole Life Insurance Pros and Cons

Pros

- Permanent Coverage: Lasts your entire life, ensuring peace of mind[2][3].

- Guaranteed Death Benefit: Your family receives a payout, regardless of when you pass[3].

- Fixed Premiums: Predictable costs over your lifetime[2].

- Cash Value Growth: Builds savings you can borrow against, grows tax-deferred[2][3].

- Estate Planning Benefits: Useful for inheritance and covering estate taxes[1][2].

Cons

- Higher Premiums: Substantially more expensive than term policies[2].

- Slow Cash Value Growth: Especially in the first 10-15 years; initial premiums go toward fees and commissions[2].

- Lower Returns: The guaranteed growth rate is conservative compared to market investments[2].

- Complexity: Policies can be difficult to understand without expert guidance[1][2].

- Limited Flexibility: Fixed premiums and rigid structure can be tough if your financial situation changes[1][2].

“High costs and slow early cash value growth are significant drawbacks. Keep in mind cash value may take years to accumulate unless a large premium is paid up front.” – Western & Southern Financial Group (2024)[2]

Key Takeaway: Whole life insurance is best for those seeking lifelong protection, predictable costs, and cash value—but affordability and patience are required.

Comparison Table: Term vs. Whole Life Insurance

| Feature | Term Life | Whole Life |

|---|---|---|

| Average 2025 OK Rate (Age 40, $250k) | $28/month | $210/month |

| Renewal Option | Yes (may increase) | Not needed |

| Cash Value | None | Builds steadily |

| Policy Loans | Not available | Available |

| Estate Planning | Minimal | Significant |

| Best For | Short-term needs, low cost | Legacy planning, lifetime security |

Rates from ValuePenguin and Oklahoma Insurance Department (2025)[6]

Oklahoma Whole Life Insurance Rates and Trends

- Average Whole Life Premium (Age 40, $250,000 coverage): $210/month (2025)[6]

- Average Term Life Premium (Age 40, $250,000 coverage, 20-year): $28/month (2025)

- 2025 Trend: Slight premium increase due to regulatory updates and inflation; cash value growth rates remain stable.

- Top Oklahoma Insurers: New York Life, State Farm, Mutual of Omaha—each rated A or higher by AM Best (2025).

“A.M. Best rates New York Life ‘A++’ for financial strength and claims-paying ability.” – AM Best Rating Report (2025)

Interactive Tools: Calculators & Widgets

Whole Life Insurance Premium & Cash Value Calculator (Oklahoma)

Estimate your costs and cash value growth. Enter your age, coverage amount, and health status. See projected premiums and cash value at year 5, 10, 20, and 30.

Sample: Age 40 • $250k

| Year | Projected Cash Value |

|---|

For illustration purposes only. This tool is a simplified estimator, not a quote or contract.

Actual premiums, guarantees, dividends, loans, and cash values vary by carrier, product, underwriting, riders, and

current interest/crediting rates. Consult a licensed Oklahoma agent for an official illustration.

Buyer Personas: Who Chooses Whole Life in Oklahoma?

- Oklahoma Families: Seeking lifelong protection, predictable costs, and a legacy for children.

- Farmers: Using whole life for estate planning and succession, ensuring land and assets transfer smoothly.

- Small Business Owners: Leveraging policies for buy-sell agreements, key person coverage, and business continuity.

Case Studies: Oklahoma Families, Farmers, and Small Businesses

Case Study 1: The Smith Family (Oklahoma City)

Profile:

- Married couple, ages 38 and 41, two children, moderate income.

- Chose $250,000 whole life policy for each parent.

Outcome:

- Fixed premiums: $185/month per policy.

- Cash value after 15 years: $38,400.

- Used policy loan to cover unexpected medical expenses.

“The cash value loan helped us avoid high-interest credit cards during a tough year.” – Jennifer Smith, Oklahoma City (2024)

Case Study 2: The Harper Family (Enid, OK)

Profile:

- Family-run farm, grandfather and two sons, legacy planning.

- Purchased $500,000 whole life policy for grandfather.

Outcome:

- Policy structured for generational transfer.

- Death benefit will cover estate taxes and ensure farm remains in family.

- Cash value used to fund equipment upgrade.

“Whole life insurance allowed us to plan for the future of our farm and keep it in the family.” – Tom Harper, Harper Family Farms (2025)

Case Study 3: Bookstore Owner (Norman, OK Small Business)

Profile:

- Independent bookstore, owner age 45.

- Whole life policy used for business buy-sell agreement.

Outcome:

- Ensured business continuity in case of owner’s death.

- Cash value used as collateral for a business loan.

“We leveraged our policy’s cash value for a crucial expansion loan.” – Sarah Lee, Owner, Kaleidoscope Books (2025)

Expert Quotes & Industry Endorsements

“Whole life insurance offers guaranteed death benefits and cash value, but buyers must understand the higher costs and slow early growth.” – Jeff Root, Licensed Life Insurance Agent, RootFin (2023)

“The most important factor for Oklahoma buyers is working with an insurer rated ‘A’ or higher for financial strength.” – Michelle B. Jackson, Insurance Analyst, Oklahoma Insurance Department (2025)

“You could likely achieve higher returns by buying term and investing the difference, but you lose the guarantees and tax advantages.” – Michael Kitces, CFP, Nerd’s Eye View (2024)

FAQ: Whole Life Insurance in Oklahoma

Q: How quickly does whole life cash value grow?

A: The growth is slow in the first 10-15 years. Most policies reach substantial cash value after 20+ years[2].

Q: Can I borrow from my policy in Oklahoma?

A: Yes, policyholders can borrow against cash value for emergencies or major expenses[3].

Q: What are the best-rated insurers in Oklahoma?

A: New York Life, State Farm, and Mutual of Omaha, all rated ‘A’ or better by AM Best.

Q: Is whole life insurance right for me?

A: Take our interactive quiz:

- Are you seeking permanent coverage?

- Do you value predictable costs?

- Is estate planning important for you?

If you answered yes to two or more, whole life may be a good fit.

Key Takeaways

- Whole life insurance offers permanence, predictability, and cash value—but costs more than term policies.

- Oklahoma residents use whole life for family protection, farm succession, and small business continuity.

- Use our calculator and comparison tools to model costs and outcomes before buying.

Conclusion

Whole life insurance provides lifelong coverage and financial security, making it valuable for Oklahoma families, farmers, and business owners with long-term goals. While higher premiums and slow early cash value growth are real drawbacks, the benefits of estate planning, guaranteed payout, and access to cash value make it a wise choice for many. Use the tools, expert insights, and local stories in this guide to make an informed decision tailored to your needs.

References

[1]: Kendal at Home – Term Life vs. Whole Life Insurance

[2]: Western & Southern Financial Group – Guide to Whole Life Insurance: Pros and Cons

[3]: New York Life – Whole Life vs Universal Life Insurance

[4]: Funeral Advantage – Term vs Whole Life Insurance: Pros and Cons

[6]: ValuePenguin – Whole Life Insurance Rates

: Oklahoma Insurance Department – Life Insurance Rate Guide

: AM Best – Rating Report: New York Life

: Local Testimonial: Jennifer Smith, Oklahoma City

: Harper Family Farms, Enid, OK

: Kaleidoscope Books, Norman, OK

: RootFin – Whole Life Insurance Pros and Cons

: Oklahoma Insurance Department – Industry Analyst Interview

: Nerd’s Eye View – Whole Life vs Term Analysis

Editorial Policy and Author Credentials

Author:

William Noel

Licensed Oklahoma Life Insurance Agent, 6+ years experience.

Editorial Policy:

All content is reviewed for accuracy, updated regularly, and sourced from reputable industry publications, regulatory authorities, and Oklahoma-specific case studies. We adhere to strict standards for expert quotes and market data.